Journal Entry For A Sale

What is a Sales Credit Journal Entry?

Sales credit journal entry refers to the journal entry recorded past the company in its sales periodical when the company makes any sale of the inventory to a third party on credit. In this case, the debtor'southward business relationship or business relationship receivable business relationship is debited with the corresponding credit to the sales account.

Table of contents

- What is a Sales Credit Journal Entry?

- How to Record Entry of Sales Credit?

- Example of Sales Credit Journal Entry

- Example #1

- Example #two

- Example #3

- Example #4

- Instance #5

- How to show Credit Sales in Fiscal Statements?

- Advantages

- Limitations

- Important Points

- Conclusion

- Recommended Manufactures

How to Record Entry of Sales Credit?

When the goods are sold on credit to a heir-apparent, the account receivable account debits, increasing the company's assets equally the corporeality is receivable from the third political party. The corresponding credit will be in the sales business relationship, increasing the company's revenue. The entry to tape the sales on credit is equally follows:

| Particulars | Dr ($) | Cr ($) |

|---|---|---|

| Business relationship Receivables A/C …..Dr | 30 | |

| To Sales A/C | Thirty |

When the company receives the greenbacks against the goods sold on credit, the cash accounts volition exist credited as in that location is the receipt of the money against the appurtenances sold on credit. There volition be corresponding credit in the accounts receivable accounts as the account was initially debited at the time of sales of goods and thus will be credited once the amount is received. The entry to record the receipt confronting the sales on credit is as follows:

| Particulars | Dr ($) | Cr ($) |

|---|---|---|

| Cash A/C …..Dr | Xxx | |

| To Accounts Receivable A/C | XXX |

Instance of Sales Credit Journal Entry

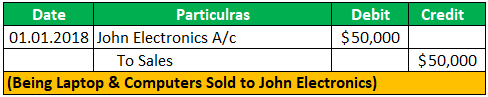

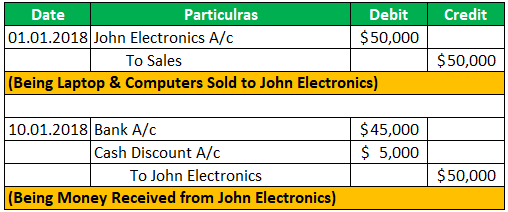

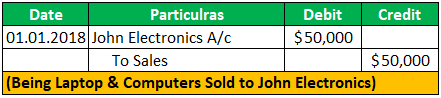

Case #i

Apple Inc is a laptop and estimator dealer, and it sold appurtenances to John Electronics on January 1, 2018, worth $50,000 on credit. Its credit period Credit period refers to the duration of time that a seller gives the buyer to pay off the amount of the product that he or she purchased from the seller. It consists of three components - credit analysis, credit/sales terms and drove policy. read more is fifteen days. It means John Electronics must make the payment on or earlier January thirty, 2018.

Beneath are the journal entries in the books of Apple tree Inc:

At the fourth dimension of sale of laptop & Reckoner:

At the time of Receipt of Payment:

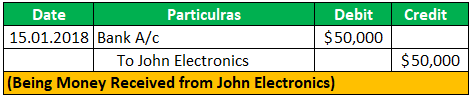

Case #2

Apple Inc givescash discounts Cash discounts are straight incentives and discounts provided past whatever company to their customers in commutation for paying their bills on fourth dimension or before the due date. This is a common practice, and the disbelieve may differ from one visitor to the next depending on the terms and conditions. read more than or early payment discounts. In the to a higher place example, Apple Inc is offering a ten% discount if John Electronics makes the payment on or earlier January ten, 2018. Accordingly, John Electronics fabricated the payment on January 10, 2018.

Below are the periodical entries in the books of Apple Inc:

Example #3

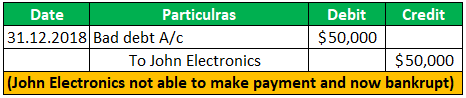

In the higher up example, John Electronics could not make payment by January 30, 2018, and it went bankrupt. And Apple Inc believes that outstanding debt is unrecoverable and is a bad debt at present.

Below are the journal entries in the books of Apple Inc:

John Electronics will pass access for bad debt Bad Debts tin exist described every bit unforeseen loss incurred by a business organisation organization on business relationship of non-fulfillment of agreed terms and conditions on account of sale of goods or services or repayment of whatsoever loan or other obligation. read more than at the end of the financial yr.

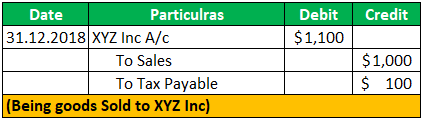

Case #four

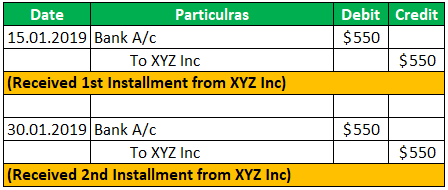

ABC Inc sold appurtenances worth $1,000 to XYZ Inc on January 1, 2019, on which x% revenue enhancement is applicable. XYZ Inc will make payment in two equal installments to ABC Inc.

Below entries volition be passed in the books of ABC Inc:

At the fourth dimension of credit sales:

In the above example, we presume the basis value of appurtenances is $1,000. Therefore, nosotros have charged ten% of tax on that value, which ABC Inc volition collect from XYZ Inc and pay to the regime, and ABC Inc tin take input credit of the same amount and claim a refund from the government.

At the fourth dimension of receiving of 1 Payment:

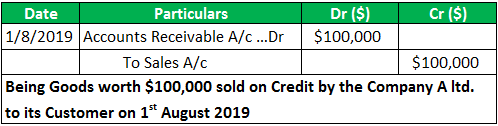

Example #5

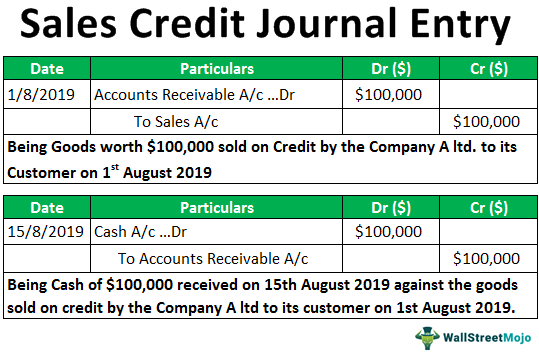

For example, at that place is visitor A Ltd. which deals in selling the different products in the market. On August 1, 2019, it sold some goods to 1 of its customers on credit, amounting to $100,000. When selling the goods, the customer decided to pay full against the appurtenances received after 15 days. On August 15, 2019, the customer paid the whole corporeality to the company. Now, how will the firm pass the journal entry to record the sales of the goods on credit and the receipt of greenbacks A cash receipt is a minor document that works every bit evidence that the corporeality of cash received during a transaction involves transferring cash or greenbacks equivalent. The original copy of this receipt is given to the customer, while the seller keeps the other copy for bookkeeping purposes. read more against the sales of goods?

Solution

On August 1, 2019, when the visitor sells the goods on credit to the heir-apparent, they will debit the business relationship receivable business relationship with the corresponding credit to the sales account. Therefore, the entry to record the sales on credit is as follows:

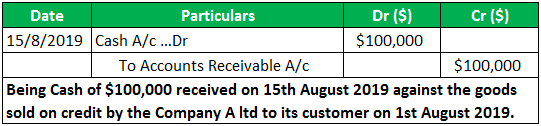

On August 15, 2019, when the customer paid the whole amount in cash to the company confronting the goods sold on credit on August 1, 2019, the cash accounts will be credited with the corresponding credit in the accounts receivable accounts. The entry to record the receipt against the sales on credit is every bit follows:

How to testify Credit Sales in Financial Statements?

Now we will understand how to show all the to a higher place entries in financial statements Financial statements are written reports prepared by a company's direction to present the company'southward financial diplomacy over a given flow (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Argument, Cash Flows, and Shareholders Disinterestedness Statement, must exist prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. read more .

- Credit Sales: Sales, whether cash or credit, will come in turn a profit & loss a/c under the income side with the auction value of goods.

- Debtors: Debtors areelectric current avails Electric current assets refer to those short-term assets which can exist efficiently utilized for business concern operations, sold for immediate cash or liquidated within a yr. It comprises inventory, cash, cash equivalents, marketable securities, accounts receivable, etc. read more than and will come under the assets side of the balance sheet under existing assets.

- Bank: Banking company balance is also a current nugget. Therefore, it will show under the assets side of the residual canvass under existing assets. On the receipt of client payment, the depository financial institution corporeality will increase, whereasdebtors A debtor is a borrower who is liable to pay a certain sum to a credit supplier such as a bank, credit carte company or goods supplier. The borrower could be an individual like a home loan seeker or a corporate body borrowing funds for business organisation expansion. read more than volition subtract. Thus, the total balance of current assets will non remain the same.

- Disbelieve: Whatsoever discount given to the dealer comes under the expenditure side of the profit & loss account, decreasing the company's profitability.

Advantages

- They help record the transaction involving the auction of goods on credit by the company appropriately, keeping track of every credit sale involved.

- With the help of a sales credit journal entry, the company can check the remainder due to its customer on whatsoever date. In addition, information technology will help the company monitor the balance outstanding of the customer in instance the customer approaches again for credit sales Credit Sales is a transaction type in which the customers/buyers are allowed to pay up for the bought item subsequently instead of paying at the exact fourth dimension of purchase. It gives them the required fourth dimension to collect money & make the payment. read more than .

Limitations

- If the person recording the transaction commits any mistake, it will evidence the incorrect trade in the company's books of accounts.

- When many transactions are involved in the company, recording the sales credit journal entry for every visitor transaction becomes problematic and time-consuming. It besides increases the chances of mistakes by the person involved in such a matter

Of import Points

- When the goods are sold on credit to the buyer, the business relationship receivable business relationship will be debited Debit represents either an increase in a visitor's expenses or a decline in its revenue. read more , which will lead to an increase in the company's assets as the amount is received from the third party in the future. Therefore, information technology leads to the asset creation of the company and is shown in company'south rest canvas A remainder sail is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the visitor at a specific indicate in time. Information technology is based on the bookkeeping equation that states that the sum of the total liabilities and the possessor's capital equals the total assets of the company. read more unless settled.

- When the appurtenances are sold on credit to the buyer of the goods, the sales account will be credited in the company's books of accounts. Therefore, it will increase the acquirement Revenue is the amount of money that a business can earn in its normal form of business by selling its goods and services. In the case of the federal government, it refers to the full amount of income generated from taxes, which remains unfiltered from any deductions. read more than and reflect in thecompany'southward income statement The income statement is one of the company's financial reports that summarizes all of the company'south revenues and expenses over fourth dimension in society to decide the company's profit or loss and measure its business action over time based on user requirements. read more than during the auction menses.

Conclusion

Sales credit journal entry is vital for companies that sell their appurtenances on credit. At the time of sales on credit, accounts receivable accounts volition be debited, which will be shown in the residuum sheet of the company equally an nugget unless the corporeality is received against such sales, and the sales account will be credited, which will be shown as revenue in the income argument of the visitor.

It helps record the transaction involving the sale of appurtenances on credit by the company appropriately, keeping track of every credit sale involved.

Recommended Articles

This commodity has been a guide to Sales Credit Journal Entry. Hither we talk over the virtually common example of a journal entry of credit sales along with explanations, advantages, and limitations. You can learn more about accounting from the post-obit articles –

- Purchase Credit Journal Entry

- Prepaid Expenses Periodical Entry

- Record Unearned Acquirement Journal Entries

- Cost of Appurtenances Sold Journal Entry Examples

Journal Entry For A Sale,

Source: https://www.wallstreetmojo.com/sales-credit-journal-entry/

Posted by: flowersarkly1973.blogspot.com

0 Response to "Journal Entry For A Sale"

Post a Comment